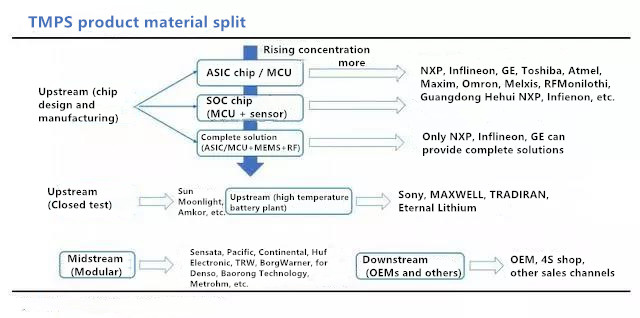

The TPMS industry chain is divided into upstream component links, midstream module links, downstream OEMs and aftersales links.

From the perspective of dismantling, the components required for upstream TPMS are mainly chips, batteries, and antennas. At the transmitting end, the chip part is the core of TPMS product performance and durability, accounting for 40% -50% of the cost of the TPMS transmitting end. The lithium sub-battery reached 16%.

At the receiving end, TPMS products are mainly divided into three parts: chip, RF / LF antenna and display. Because most of TPMS are front-loaded products at present, the display is generally integrated with the display panel such as the instrument panel or the central control, and no additional purchase is required.

A. The upstream chip design and manufacturing process: The chip includes MCU chip, MEMS sensor chip, RF radio frequency chip, and LF low frequency wake-up chip. There are many manufacturers who design and manufacture these chips, but those who can integrate these chips into TPMS transmitter / controller chips include Infineon, NXP, General Electric, Melexis, etc, large TPMS chip supplier, the world's market share for 12 consecutive years.

The rise of domestic chip manufacturers will help break the monopoly of foreign manufacturers, and the cost of TPMS chips is expected to fall. Domestic manufacturers such as Guangdong Hewei, Ningbo Yejie, Hefei Jiefa have also entered the TPMS transmitter / controller chip manufacturing process. In July 2016, Guangdong Hewei released the world's smallest TPMS chip solution, becoming the first company in Asia to have Manufacturers of TPMS chip capabilities; In April 2018, Ningbo Jiejie released TPMS chips that have passed vehicle-grade certification, and has shipped 300,000 units, successfully entering the automotive front-end and rear-end markets. With the growth of the domestic market, domestic manufacturers are expected to gain further share.

B. Upstream chip packaging and testing factory and battery factory link: The main supporting packaging and testing manufacturers of Soc chip supplier Infineon and NXP (Freescale) are mainly ASE, Amkor. In the field of high-temperature lithium subbatteries used by TPMS, the technical threshold is relatively high. The mainstream manufacturers include Sony, Japan's MAXWELL, Israel's TADIRAN, Switzerland's Renata, and domestic eternal lithium-ion manufacturers.

C. Midstream module manufacturers: It is the most intense part of the competitive landscape. Manufacturers purchase TPMS chips, batteries, antennas, etc., and make them into TPMS products through SMT placement, assembly, packaging and testing. Taking Baolong's production of TPMS products as an example, the module link manufacturers mainly play the following roles:

1.Design compact packaging structure, matching various wheels, withstanding centrifugal force above 2500G;

2.Design RF antenna to ensure stable data transmission;

3. Develop related algorithm programs to realize TPMS sleep / wake, automatic tire positioning and other functions;

4, using laser welding sealing technology, the shell needs to reach the protection level of IP6K9K;

5. Ensure real-time response of inflation and deflation. TPMS monitoring and valve inflation do not interfere with each other.

Module link market structure: The domestic market and the global market are both oligopolistic. At present, about 90% of the global market share in this segment has been occupied by the five major manufacturers Schrader, Continental, Pacific Industries, Trina, and Hoover. Among them, Schrader occupies half of the global market share, and the mainland market share is 25%. about. In the domestic market, Baolong Technology is an independent leader, with a market share of about 23% in 2018 (here refers to the market share of the launcher), mainly supporting independent brands and a small number of joint venture customers. The mainland and Schrader have market shares in About 20-30%, the rest of the market is divided up by Lianchuang Electronics, Zante, Iron General, Tongzhi Electronics, and Wantong Intelligent Control.

D. Downstream OEMs and after-sales links: Downstream OEMs refer to major auto OEMs and 4S stores, online malls, and various physical sales stores corresponding to the TPMS aftermarket. OEMs install TPMS in the OEM link, and the after-sales link is mainly to replace the damaged or insufficient TPMS. At present, TPMS has been installed in major auto markets around the world. Legislation in Europe, America, Japan, and South Korea was earlier, and its aftermarket has become more mature.